Getting health insurance that doesn’t break the bank can feel overwhelming — especially with all the options, jargon, and plans out there. But don’t worry! In this article, you’ll find everything you need to know about cheap health insurance and how to maximize your benefits without sacrificing coverage.

Whether you’re a small business owner looking for insurance for small businesses, navigating Medicare Part D, or just wanting to understand private medical insurance options, this guide is for you. Let’s dive in!

What Does “Cheap Health Insurance” Really Mean?

When you hear “cheap health insurance,” you might think it means low-quality or skimpy coverage — but that’s not always the case. Cheap health insurance simply means affordable premiums and out-of-pocket costs that fit your budget without sacrificing essential benefits. Think of insurance as a safety net — you want it to catch you when life throws you a curveball: a medical emergency, an unexpected surgery, or even routine preventive care.

Here’s a tip I always give beginners: Don’t just look at the monthly premium. Make sure to consider deductibles, copays, and network coverage when searching for affordable health insurance.

Why You Need Affordable Health Insurance

Healthcare costs can be unexpectedly high. According to recent data, the average emergency room visit can cost between $1,200 and $2,000 — and that’s just the start.

Affordable health insurance helps you:

- Access doctors, hospitals, and specialists without huge bills

- Save money with preventive care covered under many plans

- Pay lower premiums using available subsidies and HSAs

- Protect your finances from medical debt

In my experience, people often underestimate how much money a good health insurance plan can save in the long run.

Exploring Types of Cheap Health Insurance Plans

1. Private Medical Insurance

Private medical insurance is offered by health insurance companies like BlueCross BlueShield (BCBS) and Ambetter insurance. These plans often have wide networks and tiered coverage. BCBS, for example, is one of the largest providers with competitive pricing and many health insurance plans options.

2. Government Programs

- Medicare Advantage Plans: For seniors and certain eligible individuals, Medicare Advantage combines the basics of Medicare with extra benefits.

- Medicare Part D: This is prescription drug coverage available through Medicare.

- Tri Care: Military families and veterans often qualify for Tri Care, a government-backed healthcare program.

3. Health Savings Accounts (HSA)

An HSA allows you to save money tax-free to cover medical expenses. Paired with high-deductible health plans, an HSA can be a smart way to manage healthcare costs.

4. Dental Insurance

Dental insurance, such as plans offered by Cigna dental or bundled with some medical insurance, is often overlooked but important for overall health.

How to Find and Compare Cheap Health Insurance Plans

Here’s where things get practical. Comparing plans can feel like a maze, but using clear criteria helps:

| Criteria | What to Consider |

|---|---|

| Monthly Premium | How much you pay monthly |

| Deductible | Amount you pay before insurance kicks in |

| Copay/Coinsurance | The share you pay for doctor visits or meds |

| Network Coverage | Which doctors and hospitals are included |

| Prescription Coverage | Included in Medicare Part D or private plans |

Comparison Table: BCBS vs Ambetter Insurance

| Feature | BlueCross BlueShield (BCBS) | Ambetter Insurance |

|---|---|---|

| Network Size | Large nationwide network | Moderate network, more focus on specific states |

| Premium Range | Moderate to high depending on plan | Low to moderate |

| Preventive Care | Covered with no extra cost | Covered with some plans |

| Dental Options | Available as add-ons | Often included in select plans |

| Customer Satisfaction | Generally high | Variable by region |

5 Actionable Tips to Get Cheap Health Insurance Without Compromise

1. Use Health Insurance Quotes to Shop Around

Always request quotes from multiple providers. Websites and agencies can give you competitive pricing quickly.

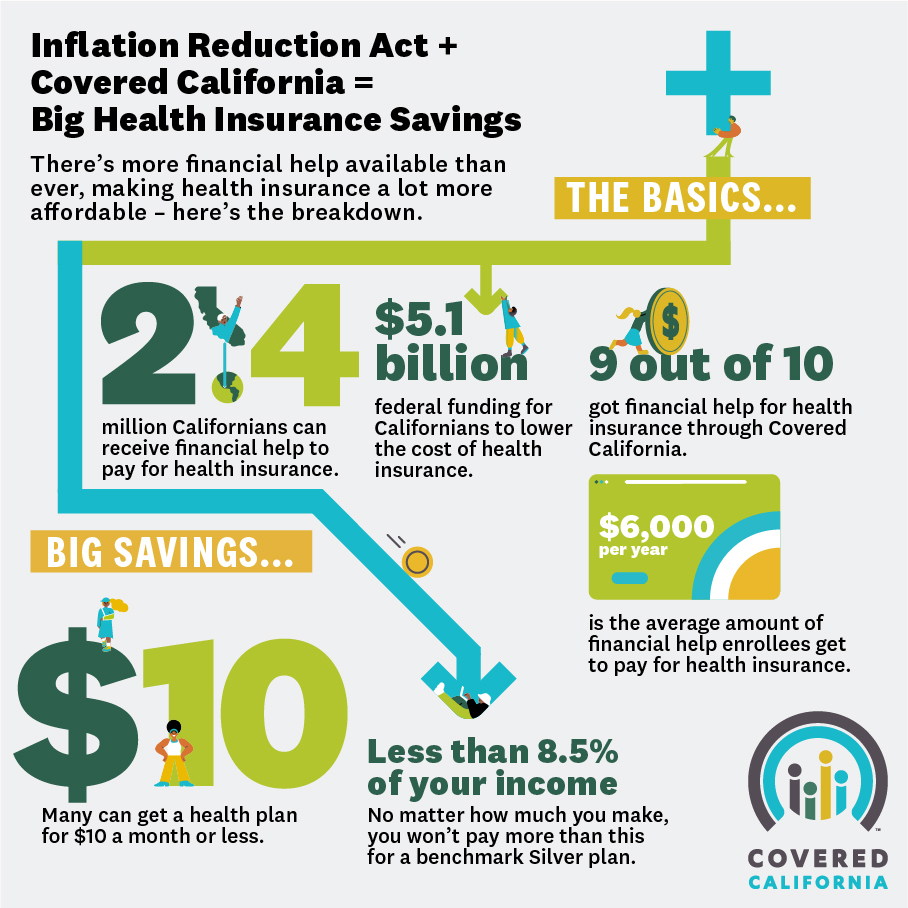

2. Leverage Subsidies and Special Enrollment Periods

The Affordable Care Act provides subsidies to reduce your premium based on income. Keep an eye on enrollment dates.

3. Consider High-Deductible Plans with HSAs

If you don’t need frequent medical care, a HSA paired with a high-deductible plan can save you money.

4. Check If You Qualify for Government Coverage

Whether it’s Medicare Advantage or Tri Care, government-backed options often cost less.

5. Don’t Neglect Dental and Vision Insurance

Sometimes bundled plans or standalone policies like Cigna dental can prevent costly problems down the line.

“For my family, the best investment was finding a BCBS plan with a good network and affordable premiums — it just made medical care easier to budget,” I once told a friend.

Common Questions About Cheap Health Insurance

1. Can I get cheap health insurance if I’m self-employed?

Yes! Many private medical insurance plans cater to the self-employed, and you can often get group rates through health insurance agencies.

2. How does Medicare Part D help with prescription costs?

Medicare Part D provides drug coverage, lowering your out-of-pocket expenses for medications.

3. Is universal health coverage available in the US?

Currently, the US does not have universal health coverage, but government programs like Medicaid and Medicare help many people.

4. How important is network coverage in health insurance?

Very important! Choosing a plan with a network that includes your doctors and preferred hospitals can save hundreds or thousands.

5. Can dental insurance be bundled with health insurance?

Yes, many insurers like Cigna or BCBS offer bundled dental and medical insurance plans.

Summary and key takeaways

Summary and Key Takeaways

Affordable health insurance doesn’t mean you have to sacrifice quality or coverage. With options ranging from BlueCross BlueShield and Ambetter insurance to government programs like Medicare Advantage Plans and Tri Care, there’s something for everyone.

Remember to:

- Look beyond premiums, considering deductibles and copays

- Use HSAs and subsidies to your advantage

- Compare multiple health insurance quotes

- Don’t forget dental insurance like Cigna dental

- Explore government-backed options if eligible

In my experience, the most important step is to stay informed and shop smart. Cheap health insurance is out there—you just need to find the right fit for your life and budget.

If you found this helpful, why not start by getting some health insurance quotes today? It might be easier than you think to find affordable, quality coverage tailored just for you.